Welcome to the 2021 SMIFC Conference Pages

The purpose of the consortium is to enhance student learning and scholarship, record best practices in investment management among SMIF partners, provide a vehicle for student networking and exchange of ideas, and provide a permanent repository of relevant literature and recorded student experiences. The SMIF Consortium builds a community of institutions with a shared vision for student success and leadership in investing. The SMIF Consortium also establishes relationships with industry partners to assist in its primary goals of student education, research, and leadership.

When:

Thursday/Friday, October 28/29, 2021

Where:

Embassy Suites by Hilton Chicago Downtown

600 North State Street

Chicago, Illinois 60654, USA

Registration Fees

The conference registration fees will be:

$149.00 per student

$199.00 per faculty member

Information

For more information, please contact:

Michelle Swick

Tel: 812-237-3365

Hotel Accommodation

The Embassy Suites Chicago Downtown is in the heart of downtown Chicago, Illinois, surrounded by shopping and entertainment venues. Located on State Street between Ohio and Ontario Streets, it is three blocks west of Michigan Avenue's Magnificent Mile. We do not endorse the Parkopedia or SpotHero web sites in any way, but they may be useful if you are trying to find somewhere to park.

We have arranged a reduced rate at the hotel for attendees. Please use the code SMF when booking.

Please note: When using the link below, the default stay is from Wednesday, October 27 until Saturday, October 30. This can be changed by clicking on the "Edit Stay" link near the top of the page. A room for Thursday, October 28/Friday, October 29 will be $149.

SMIFC2019

September 15, 2021

Dear SMIFC Partners,

On behalf of the SMIFC planning committee, I want to assure all who are attending this year’s conference that we are closely monitoring the COVID-19 developments. To keep conference attendees safe, we have decided to limit the number of registrations for this year’s conference and encourage those who plan to attend, to register by next week (week ending September 24, 2021).

The safety of all our conference attendees is of utmost importance to Scott College of Business and Indiana State University. By attending the 2021 Student Managed Investment Fund Conference, in Chicago, IL, you agree to abide by and engage in certain health and safety beneficial conduct while attending the conference. This includes, but is not limited to, wearing a mask at all times unless actively eating or drinking, maintaining appropriate physical distancing, and not attending the event if you are ill or have been recently exposed to COVID-19. These protocols are a living document that will continue to evolve as venue and local standards change. We are monitoring the COVID-19 status and following guidance from the CDC as well as following standards set forth by the venue and the State of Illinois authorities. We will execute the following best practices to help attendees stay healthy and to reduce exposure and risk.

SMIFC will:

- Room set with social distance between meeting attendees as established by the authorities.

- Banquet set-up will follow social distance protocols.

- Clearly identify entrances and exits to meeting rooms.

- Will monitor recommendations from health authorities at the state, local levels, and city officials, and protocols can be altered to meet changes in the standards

- Visit hilton.com/en/corporate/cleanstay/ for hotel’s safety protocols.

- Poster Competition. Please only 1 team member presenting at poster competition.

- Encourage attendees to get vaccinated or test 72 hours prior to attending the conference. Indiana State University has made it a policy for our students to show proof of vaccination or negative test results prior to attending the conference.

Attendees are required to:

- Wear a mask, covering your nose and mouth, at all times except when actively eating or drinking.

- Wash hands often with soap and water for at least 20 seconds, especially after going to the bathroom; before eating; and after blowing your nose, coughing, or sneezing. If soap and water are not readily available, use an alcohol-based hand sanitizer with at least 60% alcohol.

- Cover your cough or sneeze with a tissue, then throw the tissue in the trash, washing or hand sanitizing afterward

- Maintain social distancing

- Disinfect personal items such as cell phones and laptops

- If onsite and you become feverish or coughing, please stay in your room and notify your faculty advisor to report illness and do not return to the event.

Keeping everyone safe so all can enjoy the conference is our main priority. We look forward to being with all of you in Chicago.

Sincerely,

Terry Daugherty, Ph.D. |

Tarek Zaher |

Thursday, October 28, 2021

11:45 a.m. - 12:45 p.m. - Check in & Lunch

Embassy Suites, River North Ballroom

12:45 - 1:00 p.m. - Opening Remarks

Embassy Suites, River North Ballroom

Dr. Tarek Zaher, Professor of Finance/Co-Founder and Managing Director of SMIFC, Scott College of Business, Indiana State University

Dr. Terry Daugherty, Dean, Scott College of Business, Indiana State University

1:00 - 2:00 p.m. - Economic Outlook

Lindsey M. Piegza, Ph.D. Managing Director, Chief Economist, Stifel, Nicolaus & Company, Incorporated

2:00 - 2:10 p.m. - Break

2:10 - 3:10 p.m. - Recent Developments in Behavioral Finance

Embassy Suites, River North Ballroom

Charlie Bobrinskoy, Vice Chairman, Ariel Investments

3:10 - 3:20 p.m. - Break

3:20 - 4:20 p.m. - Panel Discussion:

Portfolio Management And Trading - Practical Applications In The Workplace

Embassy Suites, River North Ballroom

Jeff Kernagis, CFA - Senior Vice President, Northern Trust Asset Management

David Hemming, Head of Alternative ETF Portfolio Management, Invesco.

Jeffrey Feldman, Head trader, Wolverine Trading

Moderator: Thomas Digenan, Managing Director and Lead Equity Investment Specialist, UBS Global Asset Management

4:20 - 5:30 p.m. - SMIFC Teams Poster Session

Embassy Suites, Lakeview Room

Sponsored by Chartered Market Technician Association

5:30 - 6:30 p.m. - Manager’s Reception

Embassy Suites, Lobby

6:30 - 8:00 p.m. - Dinner, Awards Distribution, and Winning Teams Presentation

Embassy Suites, River North Ballroom.

Poster Session Competition Awards

Sponsored by CMT Association

Student Competition Awards

Sponsored by CMT Association

Competition winners will be announced and awards distributed followed by a short presentation by winning teams

Friday, October 29, 2021

8:00 - 9:00 a.m. - Breakfast

Embassy Suites, River North Ballroom

9:00 - 9:50 a.m. - Investment Management and Financial Analysis

Christopher T. Vincent, CFA, President & Chief Executive Officer CFA Chicago

9:50 - 10:00 a.m. - Break

10:00 - 11:00 a.m. - The Volume Factor in Portfolio Management

Embassy Suites, River North Ballroom

Buff Dormeier CMT, Partner & Chief Technical Analyst, Kingsview Partners

11:00 - 11:10 a.m. - Break

11:10 a.m. - 12:00 p.m. - Use of Options, Futures and the VIX® Index in Investment Fund Management

Embassy Suites, River North Ballroom

Matt Moran, Head of Index Insights, Cboe Options Institute

12:00 - 1:00 p.m. - SMIFC Partners Meeting

Embassy Suites, Lincoln Park Room

Agenda

Advisory Board

Additional Sponsorships

SMIFC Journal

SMIFC Logo

Dates and venue for next year’s conference

Recommendations for program changes

1:00 p.m. - Closing Remarks

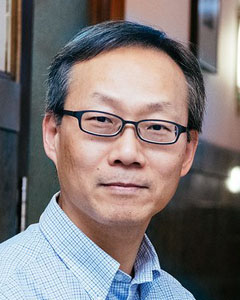

Dr. Jin Park, Chairperson - Accounting, Finance, and Insurance and Risk Management (AFIRM), Scott College of Business, Indiana State University

These projects and competitions are very generously supported by the CMT Association

Note: Project 1 and Project 2, Part 1 are open to conference attendees only.

Project 1: 2021 SMIFC Poster Session (sponsored by CMT Association)

The 2021 SMIFC poster session will be held on Thursday, October 28, 2021 at the Embassy Suites, Lakeview Room 4:20 -5:30 p.m. The poster session provides the SMIFC teams a way to display information about their SMIF including performance during 2021 year. As an incentive to participate in the poster session competition, the CMT Association will recognize and present awards for the three teams that demonstrate Posters of Excellence for outstanding performance and outstanding visual presentation. Presenters will participate in engaging their colleagues at other SMIFC schools. All presenters are responsible for bringing or delivering the posters to the conference and removing it after the conference. Posters presenters are expected to arrive at least 15 minutes before the start of the poster session. We encourage all SMIFC teams to participate in the poster session.

Submissions and Representation

Each SMIFC team should submit two copies of their posters, either as an image file or PDF, to michelle.swick@indstate.edu by 5:00 pm eastern time on October 20, 2021. One copy would have school affiliation and team member’s names. The second copy will be sent to reviewers for grading and therefore should not contain any identifying information. The number of teams (1-3 students) that can participate in this competition is limited to four teams from each institution. Please let us know, as soon possible the number of teams that plan to join this competition.

Each team is also required to report their fund time weighted rate of return (TWRR) on a spread sheet and send it to us along with a letter from the brokerage house that host their SMIF for the period from January 1, 2021 to September 30, 2021. SMIFC teams are expected to use 48 inches by 36 inches tri-fold boards to display their posters. They sell them at Walmart around $3:00 a board.

Evaluation Rubric

- SMIF performance measured by Sharpe ratio (30%)

- Visual presentation (35%)

- Presentation to judges and visitors (35%)

To determine the performance score for each team, the teams will be ranked by their risk adjusted rate of return. The team that has the highest adjusted rate of return would receive a score of 40. The score for each team would be reduced by the difference in return between its adjusted rate of return and the first team adjusted rate of return. For example, if the first team has an adjusted return of 30% and second team has an adjusted return of 27% then the second team receives a score of 37. The score on the visual presentation and presentations to visitors will be determined at the conference by the two Judges who will stop by the table of each participating team and ask questions about the team work.

Evaluation Method

We will use the Sharpe ratio to measure SMIF team’s performance over the period January 1, 2021 through September 30, 2021. The return used in the ratio is the time weighted return.

While we would like SMIF teams to be innovative in what to include on and how to set up their posters, we expect the posters to highlight among other things, the SMIF performance, history, investment policy, Investment strategies and student role in decision making process.

Poster Session Prizes (courtesy of CMT Association)

Two types of prizes will be awarded to the first three winners.

First, in kind prizes, courtesy of CMT Association and Wiley. The award package consists of:

- Copies of CMT Curriculum provided by Wiley ($225 value) per recipient or

- Course access to CMT Level I ($325 value) for all 3 winning schools.

- CMT Association will also provide free annual membership to all winning students ($325 value)

Second, cash prizes courtesy of Scott College of Business at Indiana State University

- First Place — $1000

- Second Place — $ 750

- Third Place — $500

Project 2: SMIFC Portfolio Building Competition – sponsored by CMT Association

Part 1: Portfolio Building Competition

This project is an exercise of creating a long-term investment strategy and building an investment portfolio using fundamental analysis and technical analysis. The project consists of two parts. In the first part, teams of 1 to 3 students are asked to create a paper trading portfolio with $100,000 that can be invested in stocks. Each team will create a portfolio of up to 10 stocks and write a 5-8 page (including exhibits) paper describing their investment plan and demonstrating their knowledge of analysis of economic, industrial, political, global and financial conditions, and their understanding and application of both fundamental analysis and technical analysis concepts and the criteria they used for selection, allocation, position sizing, and risk management of their portfolio. The students will use the knowledge they accumulated in part 1 of the Portfolio Building project in the live investment challenge (part 2) in January 2022. Submitted papers will be judged by members of the CMT Association, CFA Society of Chicago and Faculty from SMIFC member institutions.

Evaluation Rubric

- Analysis of economic, industrial, political, global and financial conditions (20%)

- Asset allocation and diversification (15%)

- Financial Analysis and selection of stocks

- Using fundamental analysis (25%)

- Using technical analysis (25%)

- Write up of the paper and exhibits (15 %)

Portfolio Building Cash Prize Pool: Courtesy of Scott College of Business at Indiana State University

- First Place — $1500

- Second Place — $1000

- Third Place — $500

Timeline:

- October 15, 2021 - Deadline for Paper submissions

- October 28, 2021 - Conference prizes awarded to Portfolio Building Competition Part 1 winners

Submissions and Representation

The portfolio building paper should be submitted no later than 5pm Eastern time, on October 15, 2021. Two copies of the paper should be submitted.to michelle.swick@indstate.edu. One copy would have school affiliation and team member’s names. The second copy will be sent to reviewers for grading and therefore should not contain any identifying information. We encourage all SMIFC Schools to participate in the competition. Schools that submit to paper competition should plan to have at least one member of the team present at the conference. The winning team is expected to make 10 minutes’ presentation of their paper at the conference.

Part 2: CMT Association Investment / SMIFC Investment Challenge, to be hosted in January 2022

The second part of the portfolio building competition is a CMT Association/SMIFC Investment Challenge. This is a technical analysis based simulated investment competition that will last for 8 weeks. CMT candidates and students from CMT Academic Partner Program institute and SMIF Consortium member institutions can join the competition.

Competition Parameters

Each competitor/team will begin competing with a synthetic account of $100,000/- to manage their portfolio

- Minimum Allocation 2% of your capital per trade – 1L

- Maximum Allocation 10% per trade – 5L

- You are allowed to invest in any security across the MSCI Global Index

- You are allowed to take long positions only

- The minimum holding period for any trade will be at least 3 days

- Entering a Stop Loss is compulsory for every trade. If it is not entered, the trade will be disqualified.

- Setting a profit target is not compulsory

- A minimum of 10 trades should be completed over the course of competition (entered and exited) to be eligible for final evaluation.

- All open trades will be deemed closed at the closing price of the last day of competition.

- Each trade decision (entry and exit) should be supported by your investment plan a rooted in a technical or fundamental rationale

- At the end of the competition, portfolios will be evaluated based upon the final risk adjusted return achieved across the entire period

- Competitors are required to use the designated platform at all times for managing portfolios. No ancillary entries and information, unless designated by the CMT Association will be taken into consideration

- At no point during the competition, should competitors abandon their portfolio. There should not elapse a period of 7 days without any open trades/investments

- Intraday trading will not be allowed. Positions must carry forward for at least 3 days, unless a stop-loss is triggered.

- The results of the challenge will be finalized by the CMT Association team in coordination with Optuma and cannot be disputed.

CMT Association will assist with communications and onboarding of SMIFC Schools including more complete documentation of the portfolio competition, access to their Discord Channels, and getting started on Optuma. They will create dedicated landing pages for students and faculty to access the trading tools, as well as the leaderboards throughout the competition. They will also start in September 2021 kickoff activities including introductory meetings/webinars for all SMIFC schools and student portfolio teams to provide educational material and answer questions about the live investment challenge.

Competition Prizes and Metrics of Success:

Five cash prizes will be awarded by the CMT Association to the five teams who fall in the following categories:

- Best Performing Portfolio – $1000 awarded to the portfolio which achieves the maximum risk adjusted return (highest Sharpe ratio) during the period

- Highest Absolute Return – $500 awarded to the portfolio which achieves the maximum percentage gain during the period.

- Lowest Max Drawdown – $500 awarded to the portfolio with the best risk management and smallest losses.

- Most Robust Strategy – $250 awarded to the portfolio with the highest number of valid investment ideas.

- Conviction – $250 awarded to the portfolio with the Single Most Profitable Trade.

The CMT Association will award a certificates of participation to all individuals who meet the eligibility criteria as set out in the competition rules. The association will also have a periodic recognition on social media and in Technically Speaking (the CMT Association’s Monthly Magazine) of teams with best performing ideas and best risk management.

Timeline:

- January 15, 2022 - Paper Trading Competition Begins

- January 31 - Paper Trading Competition Complete

- February 3 - Winners Announced

Congratulations to the winners of the two competitions held at SMIFC2021.

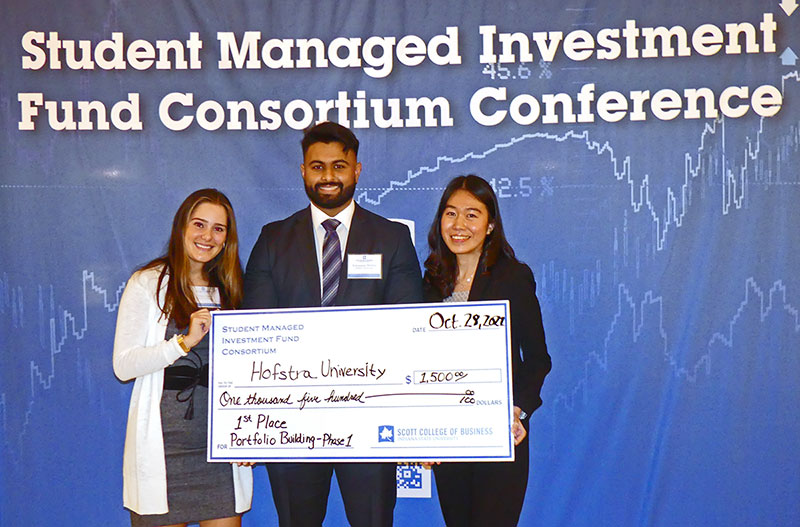

Portfolio Building Competition

First Place

Hofstra University Robinpreet Dhillon Advisor: Dr. Edward J. Zychowicz |

|

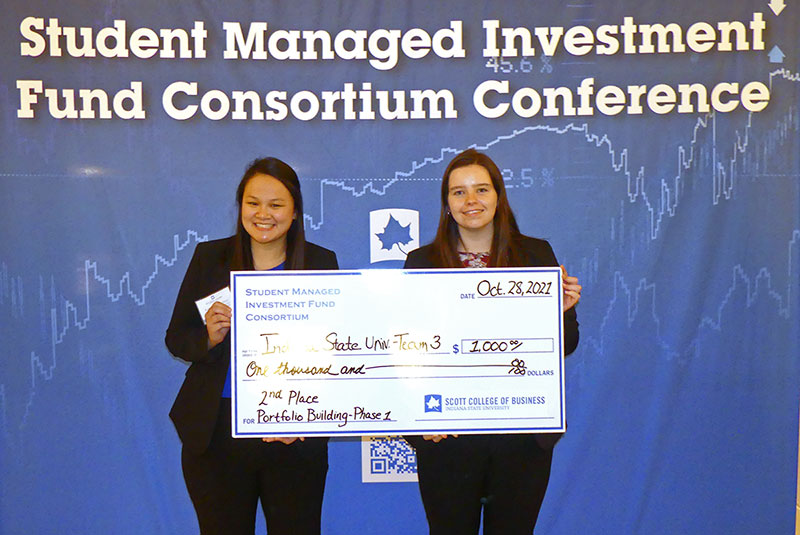

Second Place

Indiana State University Keleigh Chambers Advisors: Dr. Tarek Zaher and Matt Cohen |

|

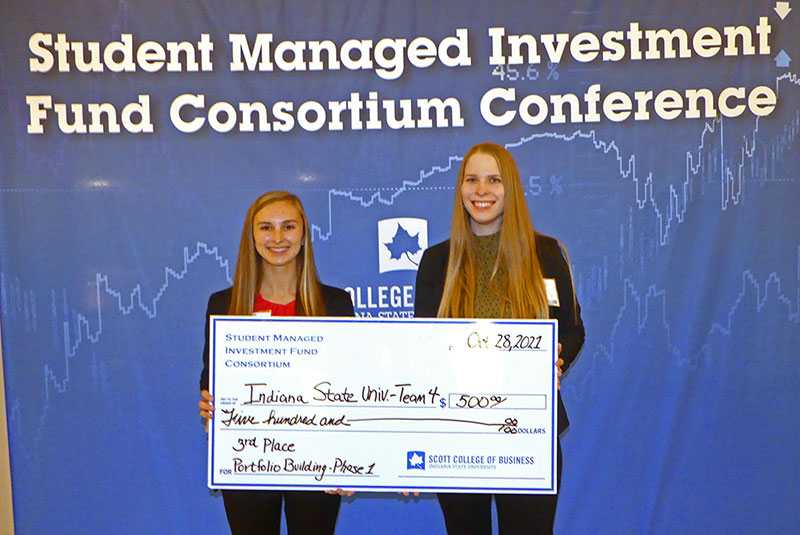

Third Place

Indiana State University Sarah Acklin Advisors: Dr. Tarek Zaher and Matt Cohen |

|

Poster Competition

First Place

University of Tennessee at Martin

Advisor: Dr. Mahmoud Haddad |

|

Second Place

Indiana State University

Advisors: Dr. Tarek Zaher and Matt Cohen |

|

Third Place

Taylor University Trevyn Nafziger Advisors: Dr. Justin Henegar and Dr. Chris Kellner |

|

Charlie Bobrinskoy

Vice Chairman, Ariel Investments

Charlie manages Ariel's focused value strategy—an all-cap, concentrated portfolio of U.S. stocks. He also spearheads Ariel’s thought leadership efforts and takes an active role in representing Ariel’s investment strategies with prospective investors, clients and major media. Prior to joining Ariel in 2004, Charlie spent 21 years as an investment banker at Salomon Brothers and its successor company Citigroup, where he rose to managing director and head of North American investment banking branch offices. Charlie actively serves the Chicago community, sitting on the corporate boards of State Farm Mutual Automobile Insurance Company and ACI Worldwide as well as the boards of the Big Shoulders Fund, La Rabida Children’s Hospital Foundation, the Abraham Lincoln Presidential Library Foundation and the Chicago Club. He also teaches monthly investing classes at two Chicago inner-city schools. Charlie graduated with an AB in economics from Duke University and earned an MBA from the University of Chicago.

Dr. Terry Daugherty

Dean, Scott College of Business, Indiana State University

Daugherty earned his B.A. at Western Kentucky University, his M.A. at the University of Alabama, and his Ph.D. at Michigan State University.

He was a postdoctoral fellow at Vanderbilt University’s Owen Graduate School of Management. After that, he went to the University of Texas at Austin as an assistant professor in the Department of Advertising. He started at the University of Akron in 2009 where he served on the faculty and in various administrative capacities, including department chair and assistant dean.

Daugherty’s scholarship is focused on examining consumer psychology and persuasion within digital marketing and advertising. He theorizes and empirically tests how individual characteristics and media properties influence cognitive processing and consumer behavior.

Thomas Digenan

Managing Director and Lead Equity Investment Specialist, UBS Global Asset Management

Tom Digenan is the Lead Investment Specialist for Equities in WMA. In his role, he is responsible for driving our equity strategy in the channel and supporting Client Advisors for Active equity products. Prior to his current role, Tom worked in the Active equity team for over 20 years, latterly as head of the US Intrinsic Value Equity team. In this role, he was responsible for US equities portfolio construction and research.

Prior to his role with the US Intrinsic Value Equity team, Tom was president of the firm’s mutual funds and relationship funds organization. Prior to joining the UBS predecessor organization Brinson Partners in 1993, Tom was a senior manager at KPMG Peat Marwick, where he worked exclusively in the investment services industry.

Tom is a member of the CFA Institute and the American Institute of Certified Public Accountants. He is formerly a Board member of CFA Society Chicago. He is also currently on the Advisory Board for the Driehaus Center for Behavioral Finance at DePaul University. Tom was an adjunct professor in the Marquette University Graduate School of Business from 2012-2016. In addition, Tom has been a guest lecturer at Northwestern University, University of Notre Dame and Creighton University. He has also served as an adjunct professor at DePaul University since 2020.

Buff Dormeier, CMT

Partner and Chief Technical Analyst, Kingsview Partners

Buff Dormeier, CMT® provides four important roles to our clientele that of a financial advisor, consultant, analyst, and a portfolio manager. Armed with proprietary indicators and investment programs, Buff dynamically advises affluent and institutional clientele on strategies to help meet their specific investment objectives in what are often uncertain investment climates. As an advisor, Buff has been named a “Best in State Wealth Advisor” by Forbes*. As an analyst in 2007, Buff’s technical research was awarded the Charles H. Dow Award**, distinguishing him as the only financial advisor to thus far win the Award. The Charles H. Dow Award is considered one of the most important recognitions in the field of technical analysis. As an accomplished portfolio manager applying advanced technical/quant analysis, some simply refer to Buff as “the geek”.

However, Buff considers himself to be an evangelist of sorts. He enjoys sharing his investment theories as a foremost expert on volume analysis presenting at international conferences such as TradeStation’s World Conference, Latin America’s Portfolio Manager’s Conference, and the World Money Show.

An award-winning author (2012’s Technical Analyst Book of the Year / Trader Planet’s Top Book Resource 2011), Buff literally wrote the book on “Investing with Volume Analysis” partnering with the Financial Times Press, Pearson Publishing and the Wharton School. Buff’s research has been further featured with press partners including Barron’s, Stock’s & Commodities, Futures and Active Trader magazines, The Financial Times, C-NBC, Market Watch as well as a variety of technical journals. Buff is featured in “Technical Analysis and Behavior Finance in Fund Management” – a European book comprised of interviews with 21 esteemed portfolio managers.

Buff is a former Fort Wayne / Indiana Marathon champion. Although his competitive distance training is on hold, Buff still enjoys a good long run on occasion. Buff is a member of the Chartered Market Technicians Association and Emmanuel Community Church. He is married to his beloved bride Kathy, father of two adored children Hadassah and Kaleo, and best friend to his Rhodesian Ridgeback Dutch.

Jeffrey Feldman

Head trader, Wolverine Trading

Jeffrey Feldman is the head trader for the Liquidity Group at Wolverine Trading.He is responsible for risk management and trading of ETFs.The liquidity desk acts as a principal market making desk for ETFs providing liquidity and transparency to the market place.Jeffrey focuses on trading equities, futures, and fixed income products.

David Hemming

Head of Alternative ETF Portfolio Management, Invesco

David Hemming is the Portfolio Manager for the Invesco Optimum Yield Diversified No K-1 ETF, plus an additional eight commodity ETF’s, 10 currency ETFs and has oversight of the European Commodity ETF’s. David started his career at State Street Global Advisors as an analyst for their European balanced funds. David was a Senior Portfolio Manager and Principal at Hermes Fund Managers, running their commodity capabilities. He started trading commodities in 2006 for the British Telecom Pension Scheme.

David holds a joint honors MA in Economics and International Relations from the University of St. Andrew's. He also received an MSc in Portfolio Management from Cass Business School, City University London.

Jeff Kernagis, CFA

Senior Vice President, Northern Trust Asset Management

Jeff recently joined Northern Trust as a Senior Portfolio Manager. In this role he will oversee a number of funds and portfolio managers in addition to helping the firm expand its FlexShares bond ETF business globally. During his 13 year tenure at Invesco/PowerShares, he spearheaded a ETF portfolio management team which grew from 0 to $40 billion in bond ETF assets globally. Jeff was also a PM at Claymore (Guggenheim) Securities where he managed both equity ETFs and bond Unit Investment Trusts. In addition, he was a senior bond trader at Mid-States (Alloya) Corporate Federal Credit Union.Prior to working in investment management, Jeff held institutional derivative sales positions at ABN Amro, Bear Stearns, and Prudential Securities.

Jeff earned a BBA degree from the University of Notre Dame and an MBA from DePaul University. He is a Chartered Financial Analyst® (CFA) charterholder and a former CFA Society Chicago Board member/officer.

Matt Moran

Head of Index Insights, Cboe Options Institute

Matt is focused on the exchange's educational efforts for pension funds, Registered Investment Advisors (RIAs), mutual funds, and other institutional investors. He has traveled to more than 100 cities worldwide to educate investors and deliver financial presentations. Prior to joining Cboe, Matt served as Trust Counsel at Harris Bank and Vice President at the Chicago Mercantile Exchange. He is an associate editor of The Journal of Index Investing and has written articles for several financial publications, including The Journal of Trading and The Journal of Alternative Investments. Matt holds MBA and JD degrees from the University of Illinois at Urbana-Champaign.

Dr. Jin Park

Chairperson - Accounting, Finance, and Insurance and Risk Management (AFIRM), Scott College of Business, Indiana State University

Dr. Jin Park joined the Scott College of Business in fall 2009 and has been the chair of Accounting, Finance, Insurance and Risk Management Department since March 2019. He teaches classes relating to risk management, property and liability insurance, and employee benefits. His research areas of interest include asset-liability management, performance, and organizational efficiency. He has awarded Best in Track Award three years in a row (2007 – 2009) at Academy of Finance. He earned his Ph.D. from Temple University, Philadelphia, PA in 2003, and was an assistant professor (2003-2009) at Illinois Wesleyan University, Bloomington, IL.

Dr. Lindsey M. Piegza

Managing Director, Chief Economist, Stifel, Nicolaus & Company, Incorporated

Dr. Lindsey Piegza is the Chief Economist for Stifel Financial. She specializes in the research and analysis of economic trends and activity, world economies, financial markets, and monetary and fiscal policies. Prior to her role with Stifel, she was the Senior Economist for an investment bank in New York City for eight years consulting clients in the U.S., Europe, Asia and the Middle East.

A highly sought-after speaker across national and international forums, Piegza is often quoted in the business press. She is a regular guest on CNBC, Bloomberg, CNN and Fox Business, as well as national radio and other business news outlets. Piegza is also a monthly op-ed contributor for The Hill.

In addition to her role with Stifel, Piegza is an instructor at the Pacific Coast Banking School, a member of the Chicago Federal Reserve Advisory Committee and a well-respected author. Piegza has published numerous academic papers in prestigious journals such as the Harvard Business Review and in textbooks from Northwestern University’s Kellogg Graduate School of Management.

Piegza is a member of the National Association for Business Economics (NABE) and American Economic Association (AEA), and named a 2019 Women of Influence by the Chicago Business Journal. She holds two degrees from Northwestern University in political science and economics, and earned her Ph.D. in economics from the City University of New York. She is a native of Chicago and is based in Stifel’s downtown Chicago office.

Christopher T. Vincent, CFA

President & Chief Executive Officer, CFA Chicago

Chris Vincent, CFA, joined CFA Society Chicago as chief executive officer in May of 2020. The majority of his investment career was spent as a fixed income portfolio manager in Chicago with two firms, William Blair and Zurich Scudder. He was head of fixed income and a partner at William Blair Investment Management (2002-2019) where he managed bond mutual funds and separate accounts. At Zurich Scudder (the successor firm to Kemper Financial), Vincent was a managing director and senior portfolio manager for institutional clients (1988-2002). His roots in the money management industry are as a corporate plan sponsor with Nestle Purina in St. Louis (1983-1988).

Vincent has been a volunteer for CFA Society Chicago and CFA Institute since 2006. He previously served as chair of the Board of Directors for CFA Society Chicago (2014-2015) and has also volunteered for various CFA Institute groups and committees, notably as a member of the Annual Conference Advisory Committee (2012-2018).

Vincent earned his CFA charter in 1990, received his undergraduate degree in finance from the University of Missouri and holds an M.B.A. from Saint Louis University.

Dr. Tarek Zaher

Professor of Finance, Scott College of Business, Indiana State University

Tarek Zaher has held a number of professional positions with the industry and provided consulting services to a number of international institutions including the World Bank, the William Davidson Institute at the University of Michigan, and the Academy for Educational Development in the United States and the Ministry of Work in Dubai. He has also offered a number of seminars in investment and international financial management at a number of institutions around the world.

Dr. Zaher is the supervisor of the investment club at Indiana State University. He also manages and supervises other international portfolios for individuals and institutions. Dr. Zaher’s research has been published in numerous prestigious professional and scholarly journals, including the Journal of Financial Research and Journal of Banking and Finance. Dr. Zaher received three research awards from professional conferences and one research certificate of excellence. He was also recognized by the Scott College of Business as the winner of the faculty research award in 2002 and the winner of the exemplary service award in 2004.

Thank you to all our sponsors without whom this conference would not be possible.

Blue Sponsor

Platinum Sponsors

Silver Sponsors

Bronze Sponsors

Judges

Thomas Digenan

Managing Director and Lead Equity Investment Specialist

UBS Global Asset Management

Buff Dormeier

Partner and Chief Technical Analyst

Kingsview Partners

Mahmoud M. Haddad

Professor of Finance

College of Business and Global Affairs

University of Tennessee Martin

Matthew Lutey

Assistant Professor of Finance

School of Business and Economics

Indiana University Northwest

Kimberly McGinnis

Director of Business Administration

College of Business and Security Management

University of Alaska Fairbanks

Samuel Sacco

Lecturer

Department of Business and Economics

Salve Regina University

Thomas Thompson

Clinical Associate Professor of Finance

College of Business

University of Texas at Arlington

Student Leaders

Ryan S. Braga

Wittenberg University

Business Management major

Treasurer, Wittinvest

Audra Doedtman

Indiana State University

Sophomore

Finance major

Networks Scholar

Analyst, ISU SMIF

Noah Heim

Indiana State University

Senior

Insurance and Risk Management/Finance

Networks Scholar

ISU SMIF

Kyle Koch

Indiana State University

Junior

Finance major

Gongaware Scholar

President, ISU SMIF

Charles Moskal

Indiana State University

Sophomore

Accounting major

Networks Scholar

Vice President, ISU SMIF

Brock Oxford

Indiana State University

Senior

Finance major

Analyst, ISU SMIF

Colton Romine

Indiana State University

Senior

Finance major

Networks Scholar

Analyst, ISU SMIF

Riley Sexton

Indiana State University

Senior

Accounting major

Secretary, ISU SMIF

Ashton Weddington

Austin Peay State University

Finance major

Larry W. Carroll Govs Fund

Louis Williams

Austin Peay State University

Finance major

Larry W. Carroll Govs Fund

We would like to thank everyone involved in making the SMIFC 2021 Conference the success it was; the organizers from Indiana State University, our speakers and sponsors who so graciously gave their support and off course the 160 faculty and students from the 27 colleges and universities who attended the conference. The event was as usual, interesting and informative with a variety of topics discussed by industry experts.

The Speakers

Lindsey Piegza, Managing Director and Chief Economist with Stifel, Nicolaus & Company started the two-day event with an overview of the US economy and where it is heading. COVID heavily influenced in the forecasts affecting everything from employment rates and a return of industry to pre-COVID capacity.

Charles Bobrinskoy, Vice Chairman of Ariel Investments, gave an interesting discussion on Behavioral Finance Biases detailing such subjects as Confirmation Bias, Overconfidence, Loss Aversion and Intuition over Data effects. Do people trade based on their gut feelings or do they follow the data?

Christopher Vincent, President and Chief Executive Officer of the CFA Society Chicago introduced the students to ESG investing. That is, the consideration of environmental, social, and governance factors in financial analysis. Once confined to a niche group of ethical or socially responsible investors, ESG is now an integral part of investment management for many.

Buff Dormeier, Partner and Chief Technical Analyst at Kingsview Partners is an experienced financial analyst and a Volume Evangelist. He detailed the idea of an index-based risk overlay in order to build and preserve wealth. As he said, “We work in securities business. We call it security because wealth provides the security to fulfil one’s dreams and actualize our pursuits.”

Matt Moran, Head of Index Insights at the Cboe Options Institute was the final speaker on Friday, ending the conference with an overview of Cboe Volatility Index (VIX). He addressed and how COVID has affected the Consumer Price Index and money supply, which in turn affects the volatility of the S&P 500 Index.

Apart from industry presentations, there were plenty of opportunities for all attendees to engage with numerous industry professionals. Of special interest was the open-ended discussion on Portfolio Management with a panel made up of Jeff Kernagis, Senior Vice President, Northern Trust Asset Management; David Hemming, Head of Alternative ETF Portfolio Management, Invesco; Jeffrey Feldman, Head trader, Wolverine Trading and Thomas Digenan, Managing Director and Lead Equity Investment Specialist, UBS Global Asset Management.

The Competitions

The Poster Competition had a lot of entries and it was a difficult job for the judges to pick the best. Not only were the teams scored on the posters themselves but also on the team’s presentation to judges and visitors. The teams were also judged on their fund’s performance from January 1, 2021 to September 30, 2021 using the Sharpe Ratio, time weighted rate of return (TWRR) and their risk adjusted rate of return.

- First Place - University of Tennessee at Martin - $1,000

- Second Place - Indiana State University - $750

- Third Place - Taylor University - $500

The CMT Association also provided copies of the CMT Curriculum provided by Wiley ($225 value) per recipient or access to the CMT Level I Course ($325 value) for all 3 winning schools. They also provided free annual membership to all winning students ($325 value).

The Portfolio Building Competition also had some very professional entries. This competition was an exercise of creating a long-term investment strategy and building an investment portfolio using fundamental analysis and technical analysis. It consisted of two parts. In the first part, teams of 1 to 3 students were asked to create a paper trading portfolio with $100,000 that can be invested in stocks. Each team created a portfolio of up to 10 stocks and wrote a 5–8 page paper describing their investment plan and analysis of economic, industrial, political, global and financial conditions, as well as their understanding and application of both fundamental analysis and technical analysis concepts. Teams were also evaluated on the selection, allocation, position sizing, and risk management of their portfolio. Competition judges include members of the CMT Association, CFA Society of Chicago, and Faculty from SMIFC member institutions. The winners were:

- First Place - Hofstra University - $1,500

- Second Place - Indiana State University - $1,000

- Third Place - Indiana State University - $500

The winning teams of the University of Tennessee at Martin and Hofstra University

Looking Forward

The CMT Association, in conjunction with SMIFC, will be offering an 8-week long Investment Challenge to start in January 2022. This competition is open to all CMT candidates and students from the CMT Academic Partner Program institute and SMIF Consortium member institutions. Details of that will published on the SMIFC website soon.

The SMIFC conference is an opportunity for faculty and especially the students of the various Student Managed Investment Funds (SMIF), whether it be organized as a class or a club, to come together, meet similar-minded students and to learn from each other as well as industry experts.

If you have a SMIF, or are thinking of starting one, then we look forward to seeing you at next year’s conference.